A practical guide to choosing your retirement plan based on taxes, flexibility, and your future.

Starting Retirement Planning? Here’s the Big Question.

If you work in the U.S., you’ve probably heard this advice:

“The sooner you start saving for retirement, the better.”

But once you’re ready to take action, the next big question is:

Which retirement account should I use?

Your employer might offer a 401(k),

while financial gurus recommend opening a Roth IRA on your own.

In this post, we’ll compare the two most popular retirement accounts in the U.S.—

401(k) and Roth IRA—based on taxes, flexibility, and who they’re best for.

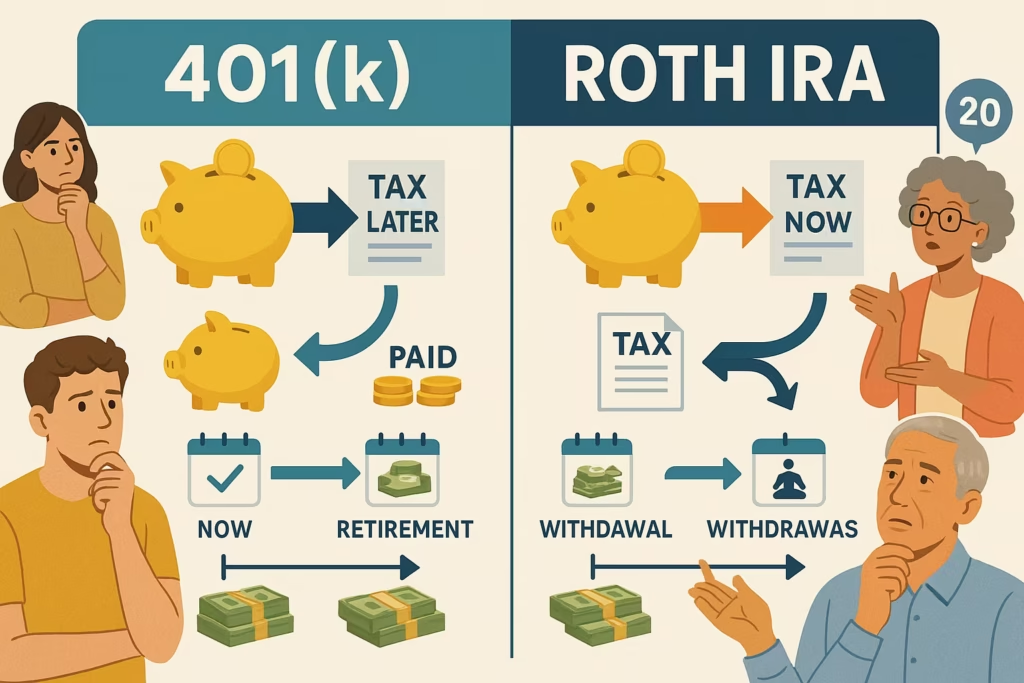

What Is a 401(k)?

- A workplace-sponsored retirement savings plan

- Contributions come from your pre-tax income, reducing your current taxable income

- You pay taxes when you withdraw in retirement

- 2025 contribution limit: $23,000 (or $30,500 if age 50+)

- Many employers offer matching contributions up to a certain percentage

Pros

- Automatic paycheck deductions = easy saving habit

- Employer matching = free money!

- Lowers current taxable income

Cons

- Withdrawals are taxed as income

- Early withdrawal penalty before age 59½

- Investment options may be limited to your employer’s plan

What Is a Roth IRA?

- An individually managed retirement account

- Funded with after-tax income, but withdrawals in retirement are tax-free

- 2025 contribution limit: $7,000 (or $8,000 if age 50+)

- Income restrictions apply: Single filers must earn under ~$161,000 to contribute

Pros

- Tax-free withdrawals in retirement

- Can withdraw contributions anytime with no penalty

- More freedom to choose your investments (stocks, ETFs, funds)

Cons

- No employer match

- Contribution limits based on income

- No upfront tax deduction

| Feature | 401(k) | Roth IRA |

| Tax benefit at deposit | Yes (lowers income now) | No (already taxed income) |

| Tax at withdrawal | Yes (fully taxed) | No (tax-free) |

| Employer matching | Often available | Not available |

| Investment flexibility | Limited by employer plan | Broad options (you choose) |

| Early withdrawal rules | Penalty before 59½ | Contributions anytime (no tax) |

| Income restrictions | None | Yes (income cap applies) |

So… Which One Should You Choose?

| Your Situation | Best Option |

| Your employer offers matching | 401(k) first |

| You expect to be in a higher tax bracket later | Roth IRA |

| You want to control your investments | Roth IRA |

| You need tax deductions now | 401(k) |

| You prefer flexible access to funds | Roth IRA |

Pro Tip: You don’t have to choose just one!

If you can afford it, contributing to both gives you more flexibility and diversification for the future.

Final Thoughts

Retirement planning isn’t just about the future—it starts with the decisions you make today.

Even if it feels complicated at first, understanding the basics of 401(k) and Roth IRA

can help you build a smart and stable financial foundation.

Start now—your future self will thank you.